How to make more of it. What to do with it. When we don’t want more of it.

All Money Resources

- Concept

- 5 Most Important Resources

- Quotes/Shorts ~1 Minute or Less

- Videos/Shorts ~5 Minutes

- Videos/Articles ~15 Minutes

- Podcasts ~2 Hours

- Books ~8 Hours

- Mental Workouts

My Thoughts

Goals

- Money is necessary to survive

- More money generally makes life easier

- Problems with money

- Money is a means to an ends

- Money has to be used to create a life we actually want to live

Concept

Money is an incredible tool. It’s necessary. It’s a requirement. We need it to live. We need it to take care of ourselves, our families, survival, and do things we want to do.

But societally it seems we’ve strayed so far from celebrating genuine happiness. We’ve evolved to want status. Status means survival. As a species, biologically we’re designed to evolve and continue the species. Life makes more life.

Yet culturally, at least in the West, we have placed such an emphasis on status that sometimes we forget to stop and smell the roses. We celebrate the new tech, the CEOs, the Gala’s, the Quarterbacks, the Singers. We host conferences, and debates, and Emmy’s and Grammy’s, and Nobel Prizes, and Double Platinums.

These bring awareness. They bring attention. But I fear they also take the meaning away from people in pursuit of their passions in the first place. The awards are created the celebrate the best at their craft. But do they celebrate the right things?

Absolutely we should recognize those who have gone where few others have. But what if we sacrificed our enjoyment and happiness to get there? What if we get to the end of our life and wonder “Is this really what I did it all for?”

It’s so easy to get sucked in to making more money. But what is the money for? Do we just want to status? We crave the validation? Sure it feels good. But at the end of our life what will it all mean?

Shouldn’t we start with where we want to go? How much money do we want to spend? What does our dream life actually cost? What are the things we’ll buy? How will we spend our time? What will we do with ourselves on a day to day basis?

More money. More money. More. When we don’t have an alternative, the answer just becomes more.

Where would we be living, with whom, in what house, with how many kids, spending money on what? How often would we go out? What car would we drive?

What hobbies would we have? What shows would we want to see? How often would we travel and what would that cost?

Figuring out how we want to live makes it far easier to obtain the money for it – It won’t be perfect by a long shot. But if we can at least have a dollar amount to strive for, we know where we’re headed and what Success will look like for us.

This page has tips on how to get more money and retire early. It’s got a few tips on how to spend it too

5 Most Valuable Resources

- paid proportion problems you solve

- make more money be more useful

- How to make wealth

- 4% rule

- retire early

- Richest man in babylon or rich dad poor dad

Actionable/Quotes/Shorts ~1 Min

“You are paid in direct proportion to the difficulty of the problems you solve”

Elon Musk

end goal – actionable steps.

IDEA: How much does your dream life cost?

Write that number down.

The rent. The fam. The vacations. What does it cost?

IDEA: What does wealthy mean? How do you know when you’ve made it?

Write that down.

Buying appetizers? Flying first class? 2-story home? Lifestyle will always creep. How do we know when we’ve made ‘wealthy’? End goals help.

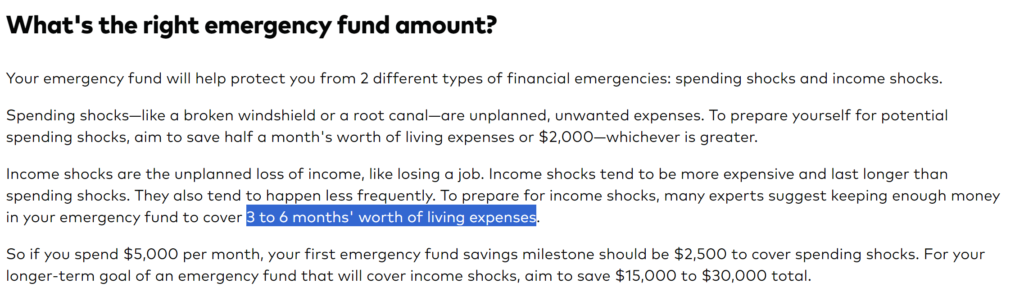

ACTION: 3-6 months of living expenses in savings

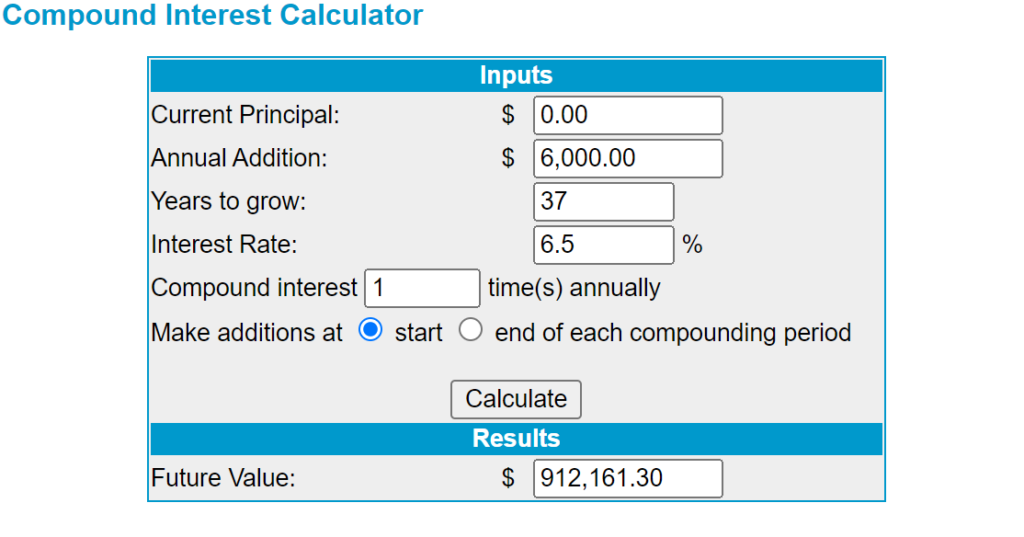

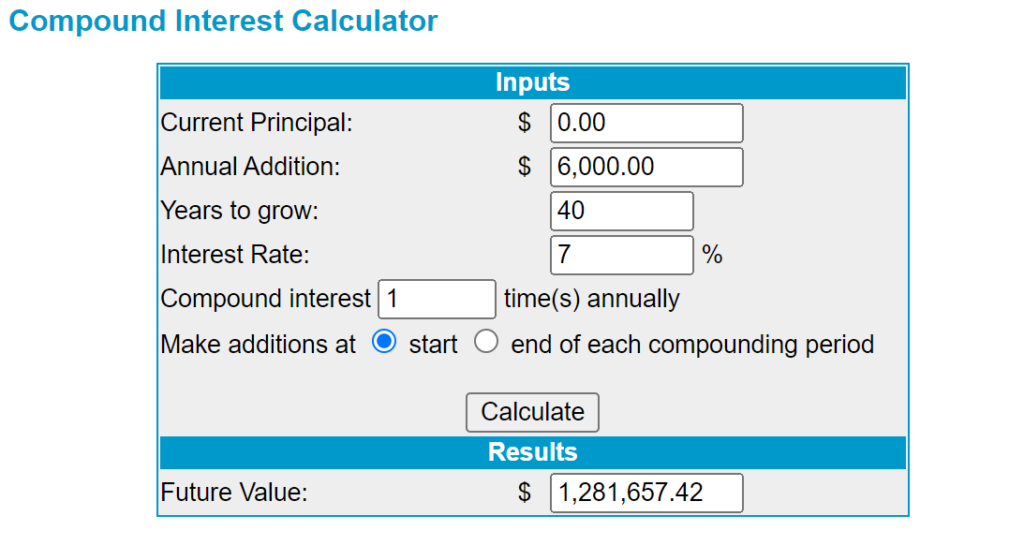

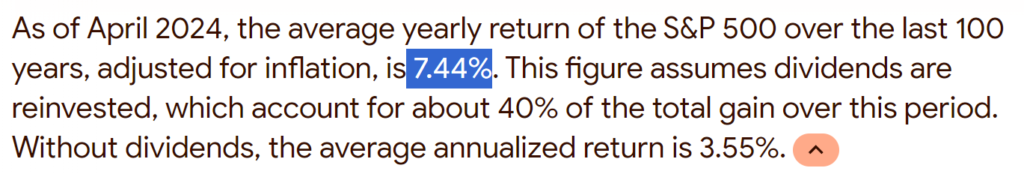

ACTION: Save 15% of all your money and invest it in the S&P 500 (for a ~7% return rate)

Richest Man in Babylon

If you are sitting & reading this wondering “Where in the hell would 15% even come from that is impossible”

See Richest Man in Babylon

“I have no gd money anyways, why the hell would i do that?”

lemme show you.

This is saving $500 each month for 40 years.

Run the numbers yourself. Calculator here.

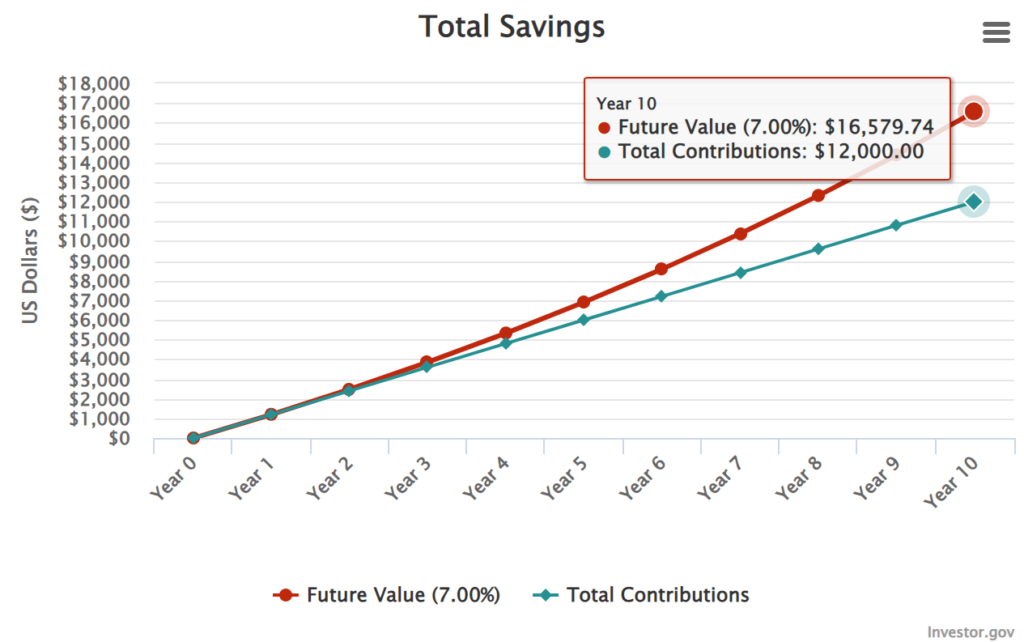

$100/month for 10 years >> $17,000

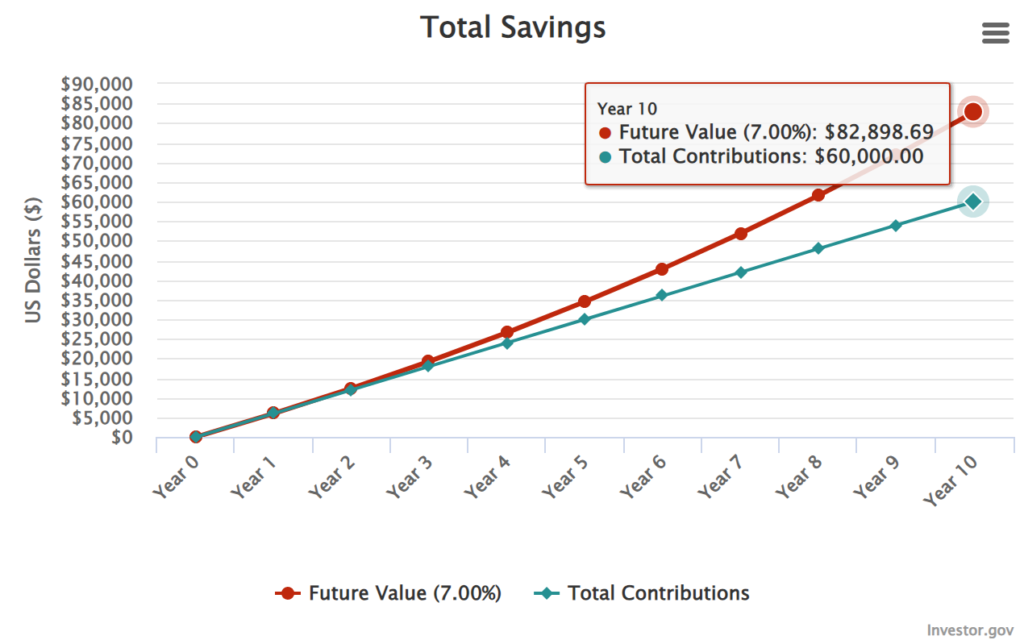

$500/month for 10 years >> $83,000

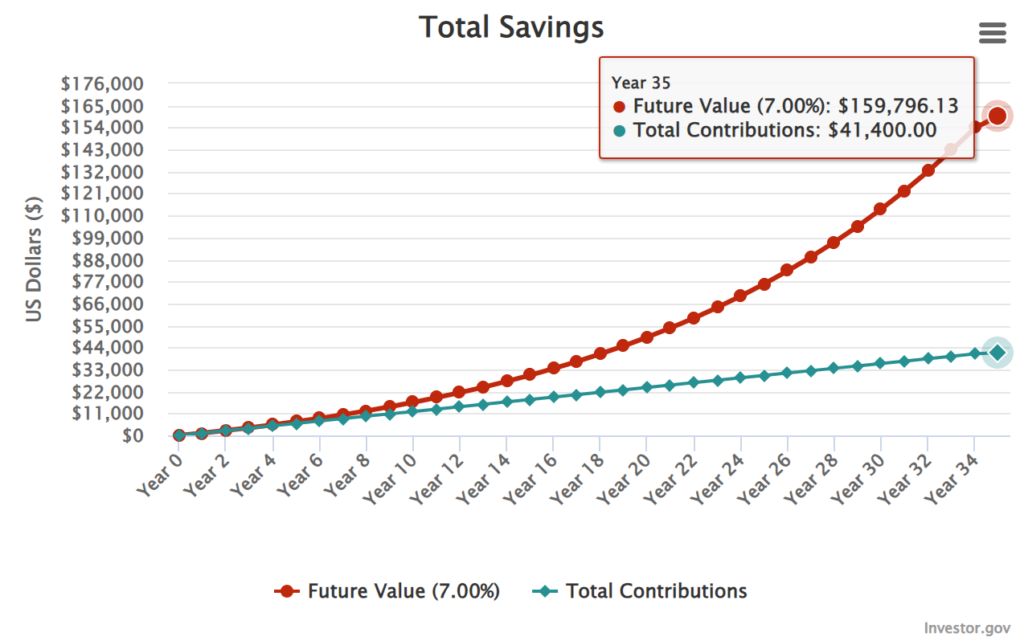

$100/month for 34 years >> $160,000

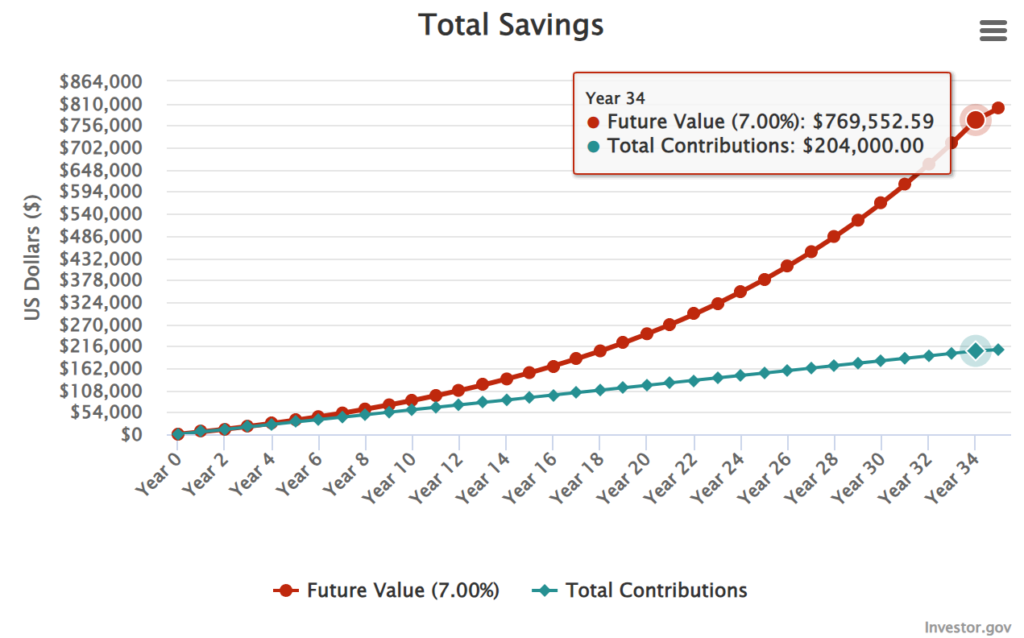

$500/month for 34 years >> ~$800,000

LEARNED: Time in market matters far more than savings rate or return rate.

start early pls.

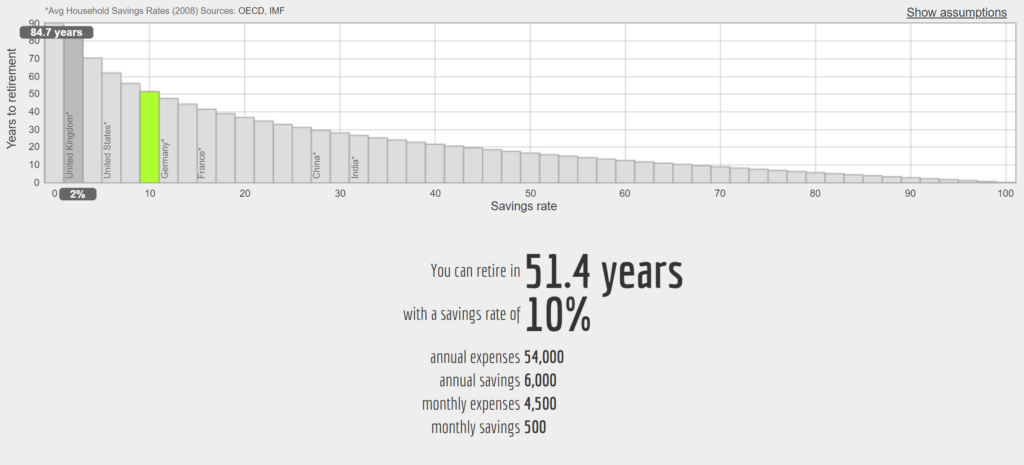

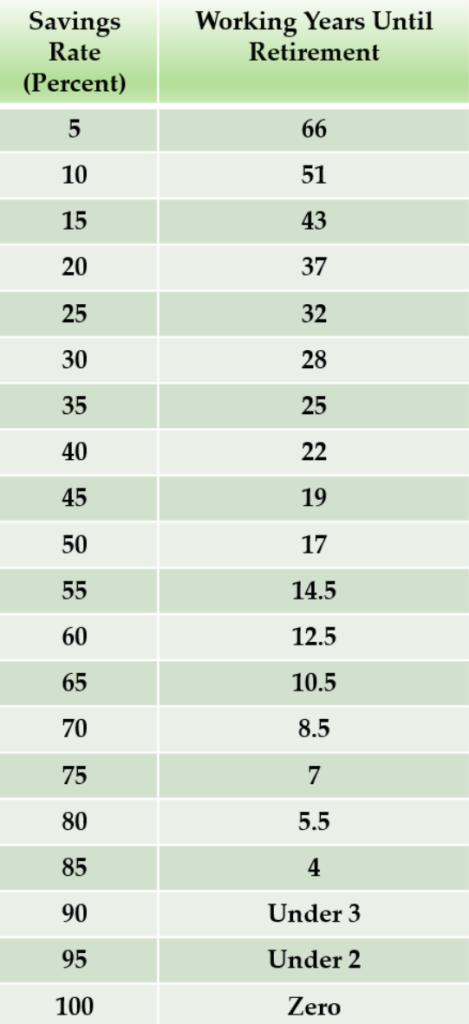

savings rate vs retirement.

make more.

QUESTION:What does your dream life actually cost?

- Money Moustache – How much do you actually need to live?

- Dan Koe – You’re after status not money

What the fuck are you naturally good at?

Source: Unknown

Somebody somewhere needs that.

Figure out how to monetize that.

Everyone is naturally talented at something.

IDEA: 10 years from now, what is a way you will enjoy making money and could see yourself doing day in day out?

“If you want to make more money, be more useful”

Source: Unknown

“If you want to make more money, change the context”

Terry Rice

If you are an Olympic level swim coach but teaching Middle schoolers, you may be winning the state championships but the ceiling is still middle schoolers. If you change the context to the Olympics you now have the potential to win the Olympics

mindsets.

“Travel and education have been the single greatest investments in my life”

Colin Douglas

Both of these have resulted in a far wider perspective. They’ve opened my ideas to alternative lifestyles and ways of living. They have had an amplifying impact on my earning later in life.

“The best investment you can make is in yourself”

Warren Buffet (10th wealthiest in the world)

QUESTION: 3 years from now will I regret not spending money on this experience?

Experiences really seem to be the absolute best investment we can make. I’ve justified trips to foreign places with friends by thinking about them as investments – Every time I travel or see new cultures my perspective opens up. I realize that everyone on Earth is just doing the best with what they’ve got.

“Anytime you open up your perspective, your ability to earn money goes up”

Colin Douglas

“Begin with the end in mind”

Stephen Covey, 7 Habits Highly Effective People

Most powerful aspect of being a human (ie make more money)

Whatever financial goals we have all start with an end vision we’re trying to acheive – Where are we trying to go?

More tips on how to reach goals here

“When I started to be useful instead of brilliant, my career took off.”

– Julia Cameron

We want that cold hard cash. We want the end. Unfortunately, we don’t just skip to the money piece. That money comes from someone somewhere. Why are they paying you? What are they paying you for? What have you done to earn that money? Somebody has to find what you are doing valuable enough to give you money for it. Perhaps the best article on money/business I’ve read is by Paul Graham. Found here

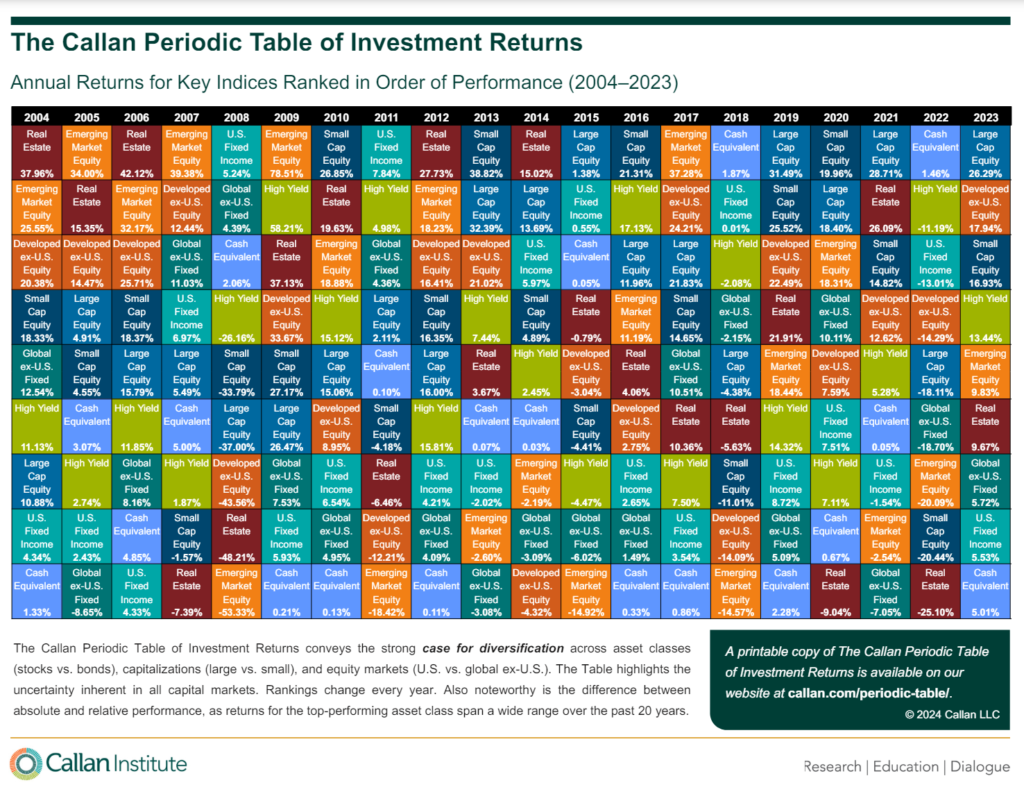

Warren Buffet wins $1 million – Bet on S&P 500 vs Professional selecting Hedge Funds

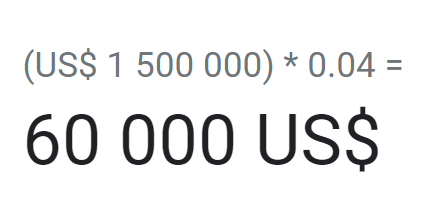

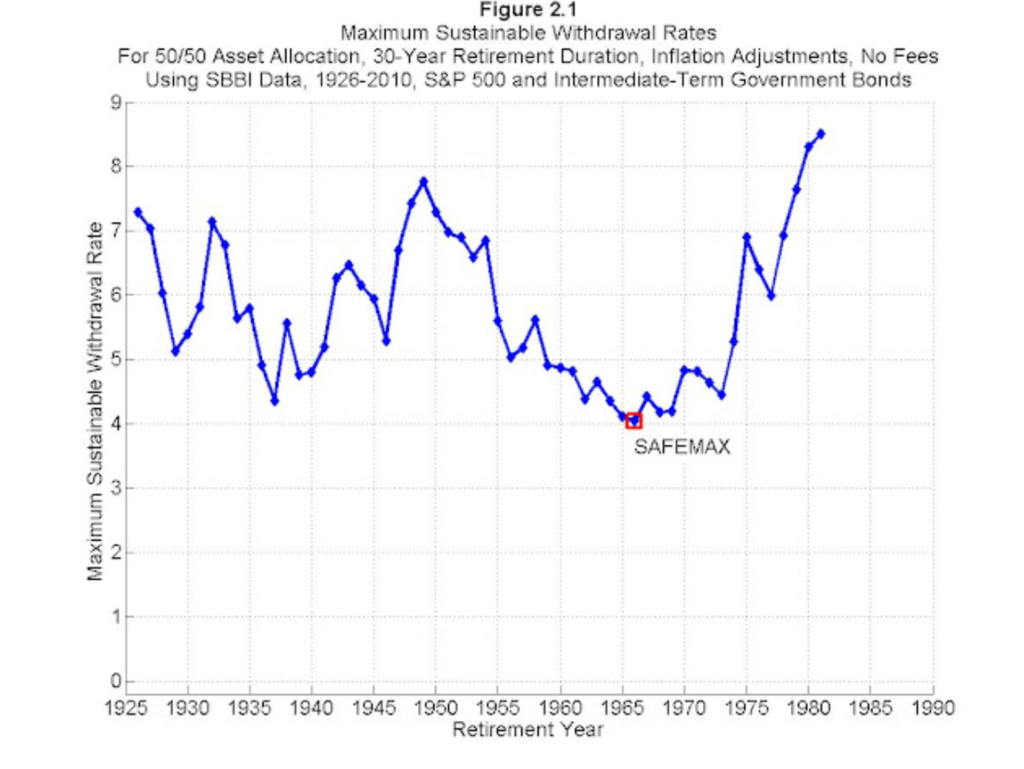

CONCEPT: 4% Rule – Withdraw 4% of retirement funds every year for retirement to have enough for retirement

4% Rule Charles Schwab

ie $1,500,000 saved up, you can safely withdraw ~$60,000 every year for retirement

CALCULATION: The converse is true – If you wanted an $80,000 annual paycheck -> 80,000/0.04 =

$2,000,0000 is how much you need saved up

“If my twenties told me anything,

Russ, Utah Freestyle

It’s stay away from people who put money over everything”

Perhaps the greatest personal $$ blog:

Mr. Money Mustache

- ARTICLE: Shockingly Simple Math Behind Early Retirement

- ARTICLE: The 4% Rule: The Easy Answer to “How Much Do I Need for Early Retirement”

^^One of the first seriously beneficial rabbit holes I found when starting my entrepreneurship journey – got me thinking there really is a better way than 9-5 grind.

can money buy happy?

STUDY: In 2008 Princeton University professors Daniel Kahneman and Angus Deaton published a study that found that income increases people’s well-being up to a point of about $75,000 per year

Article here

*Note: People’s life satisfaction went well above $120,000, but their happiness didn’t

STUDY: A follow-up study by researcher Matthew Killingsworth released another similar study. After teaming up, the 3 authors came up with this conclusion:

Princeton Article here

“This income threshold may represent the point beyond which the miseries that remain are not alleviated by high income. Heartbreak, bereavement, and clinical depression may be examples of such miseries.”

CONCLUSION: “Money can keep buying happiness for already happy people, but among the most unhappy, the money helps stave off unhappiness only to a point”

“Be fearful when others are greedy and to be greedy only when others are fearful”

Warren Buffet

We’re social animals. We want to do as others do. But words from one of the world’s greatest investors affirm that some prudence would do us well. I find this applies to more aspects of life than just money – Anytime the crowds are completely convinced of something, I think it’s in our best interest to be wary.

ACTION: Minimum 10% of your income invested. Every single paycheck (51 yrs to retire, see below)

Richest Man in Babylon

The book Richest Man in Babylon likens to throwing stones in a pond on your morning walk. 1 pebble every single day. If you forget, you don’t throw 2 the next day, you go back and throw in your one pebble. You never pay preemptively and you never pay retroactively. 1 pebble every day.

Songs

Munny Right, Jon Bellion

Since I Was Broke, Russ

Make the Money, Macklemore

~5 Mins Articles/Videos

Over time, betting on the S&P 500 is a far better bet than trying to pick companies

5 Money Questions to Ask Your Partner by Two Cents. 5 mins

~15 Mins Articles/Videos

- How to Build Wealth by Paul Graham

- Best blog for early retirement Pete Adeney

- Key to Retiring Early – 4% Rule by Pete Adeney

- Shockingly Simple Math to Early Retirement – Pete Adeney

- Advice from an African Man – Advice from an incredibly good friend on happiness without money: Life in Niger the 6th poorest country in the world

Podcasts ~2 Hours

- I Will Teach You to Be Rich by Ramit Sethi – Honest conversations with peoples pitfalls and strengths

- Dave Ramsey Show – People call in with their financial struggles and he answers their questions and gives financial advice

Books

- Money Mindset: Get more – Richest Man in Babylon by George Clason

This is an easy, short read on the mental frameworks to earn more money. Several people have told the me this book explicitly was what opened their eyes to an improved financial world. - Mindset – Rich Dad, Poor Dad by Robert Kiyosaki

This book is written totally differently.

Have not read yet. Many people recommend this, though - Totally Changed my relationship with money – Die With Zero by Bill Perkins

This book taught me to spend money. It is a tool. Once I understood how to get more money, this book transformed how I could actually use it to improve my quality of life. Spending it on frivilous things leads to a life for other people, but we can learn to spend it on things that bring us joy. It taught me to use money to create experiences not just to find them. - Advantages of avg investor – A Random Walk Down Wallstreet by Burton Malkiel

Pretty technical. If interested in the intricacies of investing, this book is good. Provides some good examples of people getting sucked in to financial bubbles. Explains how we invest when we’re afraid to miss out and some ways to avoid that. - Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel

Have not read yet but it is on the list and many people recommend

Mental Workouts